Visit the Evidence Files Facebook and Medium pages; Like, Follow, Subscribe or Share!

Introduction

In the midst of an accelerating climate catastrophe and globally growing inequality, technological innovation provides one avenue of hope. AI, if developed and applied properly, can improve scientific achievements in medicine, sustainability, and others. Advances in computing can lead the way in establishing more effective climate and energy solutions or improving our understanding of chemistry, and may invite a whole new paradigm of global connectivity. Enhancing methods for genomic sequencing will help mitigate future pandemics, and breakthroughs in nuclear fusion offer the possibility of clean, abundant energy.

Alas, the drive to employ progressively better technological systems targeting global problems remains inhibited by rampant profiteering, much of which is actually turning many prospective solutions into tools of harm. Spearheading this obstruction-for-profit are super-rich investors who possess far too much control over the development, deployment, and regulation of new tech. Despite what they say publicly, few have shown any real interest in moving forward with the betterment of humanity as the priority. [Click the article below for what one venture capitalist says about AI, and why it is ridiculous.]

Venture Capitalist Makes a Strong Argument for Regulating AI (without meaning to)

Marc Andreessen has published a long-winded, self-indulgent piece on the future of AI, that includes a broad range of “analysis” on what he thinks people are right—and, mostly, wrong—about regarding their fears about the future of an AI-driven world. Andreessen is a venture capitalist in Silicon Valley, member of Meta’s (Facebook) board of directors, co…

Instead, these venture capitalists say things that are false, or misleading at best, to rush flawed tech to the market. Perhaps the most pernicious recent example of this are LLMs which spew false outputs, reinforce hate speech or other hostility, or simply cause professional embarrassments; other AI-based programs have led to harm in medicine and criminal justice; and much of it is built on possibly the largest theft of intellectual property in the history of mankind. [Read about these problems and how AI generally works in more detail here].

Artificial Intelligence

It is hard to know what people mean by the term AI because the tendency is to characterize what it will do rather than what it is. Media take advantage of the uncertainty over the technology to bait clicks using vivid headlines like “Potential Google killer could change US workforce as we know it

One of these super-rich showmen in particular has espoused all kinds of lofty agendas, couched in terms of making the world a better place, while clearly undercut by virtually every one of his actions. Sadly, far too many people still—in the face of a cornucopia of evidence—buy into his rhetoric. Put simply, the quintessential visionary in some people’s minds—Elon Musk—is nothing more than a serial conman, driven only by his self-interest, lust for validation, and hoarding of misbegotten wealth.

His wealth is a product of fortuitous circumstance, that regularly hangs by a thread, driving him to engage in a regular and persistent scheme to defraud. The fact pattern of Musk’s business practices has strong parallels to others who have already been sent to prison.

If you are inclined to guffaw at my introduction, allow me to make the evidence-based argument. If you are still unconvinced thereafter, I am open to any fact-based counterarguments. This not a personal aversion based on the offensive, dumb, or simply horrible things Musk says, though the laundry list of choices is hard to ignore, but on his abject derision toward following the law and his indignant responses when he is called out for it. It is based on his business empire which is built on a series of deceptions and is too often engaged in practices that are unnecessarily dangerous to people and the environment.

Musk uses his self-built reputation as a visionary—which is objectively false—to artificially alter stock prices, and commit what can only be described as criminal fraud. His companies are also notorious for violations of COVID protocols, racism, sexual harassment, age discrimination, or of labor laws in general, as illustrated here, here, and here. Sure, some of Musk’s projects have had successes; one would expect little else when they are supported by billions of dollars—especially billions of dollars in taxpayer-funded subsidies (a.k.a., “giveaways”). These successes, however, did not happen because of Musk, rather they did so in spite of him.

The shining example of what Musk can accomplish on his own is Twitter (now, apparently called X, a name change beset with a host of its own problems). It is the clearest indicator of Musk’s own abilities because he fired a substantial portion of the staff that actually ran it, seems to be making all the operational decisions himself, and has since suffered one financial, technical, or legal failure after another.

As for his ‘visionary’ acumen, he holds just three patents [all co-patents, actually]: one for a car door, one for the “ornamental design” of a vehicle, and one for the specific configuration of a charging port for an EV. His writings and statements evince little more than rehashes of old ideas (that still don’t work), downright stolen ideas, or simply a limited—at best—understanding of science or math (start at 7:45), AI, business, or engineering.

In light of all this, his wealth and self-written narrative have enabled him to secure licensing and contracts, few of which ever manifest as planned or proposed, most of which cause greater harm than good. This is not the record of a visionary who cares about the future of humanity. It is the essence of a carnival barker who is just smart enough to cultivate a loyal fanbase from whom he regularly steals, and then uses that as proof to support his falling-upward narrative, which helps perpetuate his Ponzi schemes by adorning them with the appearance of credibility to the unwitting.

A lot of people write on Elon Musk, both positive and negative. Few, if any, seem to make a heavily sourced, evidence-based global case. If the following facts were laid out before you, and you had never heard of the individual or companies, would you be comfortable doing business with this person? Would you recommend a family member to this person? If the answer is no to either of these questions, at a minimum you would agree that at least some of these issues should be investigated.

Where some investigations have already happened, it would be prudent to ask why they were not done in the same way they would have if targeting some other person or entity. No system of justice can claim credibility if it treats people differently based solely on money or influence, and not on the facts and provable conduct.

I have investigated fraud cases both while in the government and in the private sector. Musk’s career is hardly an aberration from many of those with a single exception—Musk won the ultimate lottery that lucked him into billions of dollars. That should not influence the analysis of whether crimes were committed.

The Background

Musk’s propensity to commit fraud is largely driven by the considerable losses he has suffered in most of his businesses. So far, only one company has procured any real profit, itself powered by substantial violations of law, discussed further below. The inability of his other companies to succeed reveals the motivation for him to engage in deceptive practices to prop up the one that continues to keep him ranked among the richest people in the world. Nevertheless, an examination of the trajectory of the failing companies contextualizes Musk’s criminal mindset, his disregard for the negative consequences of his actions, and his obvious inability to follow through on his contractual promises.

The Boring Company

In 2017, Musk proclaimed to have a solution to traffic jams and mass public transit, that he allegedly dreamed up while stuck in Los Angeles traffic.

He proposed tunnels with automated EVs carrying 8 to 16 passengers at a time, traveling up to 150 mph. To do this, he claimed to have developed a tunneling machine that is “10 to 15 times faster” than any others out there. Engineers in the field were immediately skeptical. It turned out that the digger he bought for the project was actually a used machine that previously dug sewer tunnels.

In July of that year, Musk claimed to have received “verbal” approval from the “government” to build a high-speed portal of this kind from Washington DC to New York City. News outlets carried the story and many published the official press release of the Boring Company which claimed that for “long distance routes in straight lines, such as NY to DC, it will make sense to use pressurized pods in a depressurized tunnel to allow speeds up to approximately 600+ mph.” Then-White House Advisor Reed Cordish went on record to say no approval had ever been given.

The Boring Company did, however, eventually receive approval and funding to start the Las Vegas Loop, a much more modest proposal than the DC-NY hyperloop. As originally offered, the Las Vegas Loop would carry 4,400 passengers per hour via 60 or more fully autonomous vehicles moving at high speed, utilizing three underground passenger stations, and two tunnels for vehicles.

Things did not go well. In May 2021, Clark County regulators forbade the use of self-driving vehicles for the project, which were supposed to be Tesla-made, probably because the autopilot technology simply didn’t exist in any meaningful or safe way (more on that later). A month later, the first passengers climbed aboard human-driven Tesla sedans—obviously unable to carry 8 to 16 passengers—moving at a max speed of 30 mph. And that’s when they weren’t stuck in traffic jams, the very problem the project was designed to solve. Videos online show virtual standstill traffic inside of tunnels that do not have apparent exits for passengers to use in the event of emergencies.

Moreover, as of June 27, 2022, the project reached only 25% of the original proposal’s passengers-per-hour transit rates. This almost certainly had to do with the fact that travel was substantially slower because the not-autonomous vehicles moved through narrow tunnels, and the vehicles themselves carried 1/3 of the capacity of the originally proposed vehicles.

Another factor was that, for unfathomable reasons, the construction of the stops could not contain the needed number of passengers to meet passenger-per-hour standards because the stations would then violate fire regulations. As of May of 2023, the transport mechanism for the Las Vegas Loop remains Tesla vehicles driven by human operators at a speed limit of 30 mph. And it continues to fail to meet any of its passengers-per-hour standards in its original proposal.

Remarkably, the Las Vegas City Council voted 6-to-1 to expand the project to eighteen new stations, despite the state of the loop’s progress to that time. Part of that approval turned on the Boring Company’s promise to fully fund the venture without taxpayer dollars.

In addition, the council demanded that the company run a demonstration showing it could move 4,400 passengers per hour—a feat that it previously had not even come close to accomplishing. It performed a simulation to “prove” it could reach this milestone; the simulation abided by the same standards used for amusement park rides.

Whether it can actually move that many people remains to be seen, but the evidence to date is not positive. Before the approval, Musk tweeted that he still intended to use the Boring Company tunnels for his hyperloop plan, and even promised to begin testing that idea, but so far that has not happened despite a year’s time having passed since the proclamation. This sounds like a false claim given that Musk has never shown how it would actually work (and few experts think it ever will).

While some cities continue to express interest in the idea of a hyperloop, proposed projects elsewhere have been rejected. Aside from the fact that there remains no viable plan to create a hyperloop, another problem is that the company has not even been able to meet the very basic standards to acquire construction permits in the few places it has been granted tentative approval. When that happens, the company quietly disappears rather than make the needed adjustments. Throughout the proposal process in some places Musk has repeatedly changed the description of what the company would construct, undoubtedly making officials nervous about granting a final green-light for any project.

Relatedly, the company has never produced whatever it finally claims it will. In Chicago, a city that ultimately rejected Musk’s proposal, a short test tunnel used for the Boring Company’s presentation was described as “bumpy,” to which Musk responded that that will change “in the future.” The company could not even perfect a short sample tunnel in time for its demonstration.

Elon Musk did not “dream up” the hyperloop; it is an idea that is about two centuries old. And he never actually showed that he could make it work at scale. What the Boring Company has produced has fallen very far short of expectations.

Moreover, leaked documents from the Boring Company indicated that it would cost exponentially more to build anything near what it typically first proposes, suggesting the original proposals were never serious to begin with. Some might call this a “bait-and-switch” intended merely to acquire the contract. Cornell Law School explains what this means (emphasis mine):

A “bait and switch” takes place when a seller creates an appealing but ingenuine offer to sell a product or service, which the seller does not actually intend to sell. This initial advertised offer is “the bait.” Then the seller switches customers from buying the advertised product or service that the seller initially offered into buying a different product or service that is usually at a higher price or has some other advantageous effect to the advertiser. This is the “switch.” Normally, the switched product that the consumer buys is usually at a higher purchase price, an increased profit for the seller, or may have a less marketable characteristic than the product advertised.

Nonetheless, public officials in some places have latched on to the idea that somehow this failure will work in their communities based on nothing more than misguided belief. Heather Moraitis, vice mayor of Fort Lauderdale laid bare the danger of public officials’ belief in Musk’s narrative of his ‘genius.’ She said, “If they can build SpaceX and those rockets, they can certainly build a longer Tesla!” (This is a logical fallacy.) Since then, the Boring Company somehow received $5.5 billion in investments despite having performed no major project outside of Las Vegas, and that project remains so far an abject failure some years after its inauguration.

Starlink

Musk, in July 2020, said of his internet company, “Just plug [the Starlink satellite receiver] in & give it a clear view of the sky. Can be in garden, on roof, table, pretty much anywhere, so long as it has a wide view of the sky.” The year prior, he stated his belief that Starlink would be the key “money-maker” for SpaceX. He also mentioned that the full Starlink network would be made up of 11,943 low-orbit satellites. The satellites would have “about a terabit of useful connectivity” and were scheduled for full deployment by May of 2021. None of that has happened now more than two years later.

Musk claimed the speeds offered by the company would be “comparable” to fiber optic networks. This never happened. In fact, Starlink’s offered speeds are slower in many places in the first quarter of 2023 than they were in the first half of 2022. The finances haven’t manifested as Musk proclaimed, either.

To date, rather than being the “money-maker” for SpaceX, Starlink continues to lose money. Profitability will depend on continuously adding subscriptions in higher income markets (like the USA, western Europe, or Canada, for example), which is imperiled by increasing competition, the superior capabilities of broadband, and the difficulty in obtaining approval in many countries. Moreover, Starlink’s success depends on eventually launching a full constellation of around 30,000 satellites (of note, Musk has continuously changed the size of the constellation he is seeking to launch). A constellation of this size does not look likely to happen in the near future, at least.

Musk blamed Starlink’s lack of profitability partly on his alleged altruism in providing internet service to Ukraine.

The implication that Musk (or his company) is—or ever was—funding most of the effort there, or giving things away for free, as suggested in the above tweet is mostly false. Thousands of Starlink hardware units have been paid for and sent by European countries, such as Germany and Poland. In addition, USAID, the French government, and other “stakeholders” contributed over $15 million toward the costs of acquiring and moving the equipment to Ukraine.

In fact, according to SpaceX’s own numbers in a letter to the Pentagon, over 85% of the Starlink hardware sent to Ukraine has been fully or partially paid for by other entities. 85% is not a “small percentage” as Musk tweeted. Those entities, according to the same SpaceX documents, were paying for approximately 30% of Starlink internet service in Ukraine.

Musk has also not been “giving away” service in Ukraine across the board or offering it at regularly reduced pricing as he often claims. For most of the country’s users, it seems that the reduced service pricing was short-lived, perhaps only a month or two, if they saw it at all. As of June 1, 2023, it looks like the Pentagon is paying all of the costs of the program.

Notwithstanding Musk’s misleading statements regarding the deployment or funding of Starlink to Ukraine, the product itself seems of about average quality. In late 2020, service speeds seemed to be pretty good for satellite internet—far slower than broadband, but better than what was generally available in rural areas, and better than its two primary satellite competitors at the time—HughesNet and Viasat Exede.

The cost for Starlink’s equipment then was $499 for the hardware and $99 per month for the service. Starlink only had between 700 and 800 satellites in orbit out of the nearly 12,000 intended (then) for the full service. This was also during the beta test phase, where only a predetermined set of users had access to the network. By mid-2021, things were less good.

Reviews noted that the satellite required “near-perfect line of sight,” meaning trees, buildings and even poles could easily obstruct the signal. Starlink recommended a 100-degree cone of sight at an elevation of 25 degrees above the horizon. Many users found these recommendations difficult to meet based on their property configuration. Still, the speeds and price were the same as during the private beta test phase.

By late 2022, the price for the monthly service had gone up by about 10%, and the equipment went up by $100. At this time, there were approximately 2,000 to 2,500 satellites in operation and its user base had reached around 500,000. No reviews indicated speeds of substantial difference from those in the earliest beta phases, despite the addition of nearly 4x as many satellites.

In the first quarter of 2023, however, Starlink’s speeds are slower in many places than they were in the first half of 2022, while Starlink has since doubled its constellation to around 4,500 and its subscriber base to around 1 million. Obstruction issues at set-up, service outages and random latency continue to plague the product. For customers having difficulties with the service, Starlink customer service was rated slightly worse than a nightmare.

In August of 2022, the FCC rejected Starlink’s bid for grant money as it “failed to meet program requirements and convince FCC to fund risky proposals.” To present, SpaceX has sent about 4,500 Starlink satellites to space—well below the lowest number Musk sought for a ‘full’ constellation—with about 300 of them already inoperative.

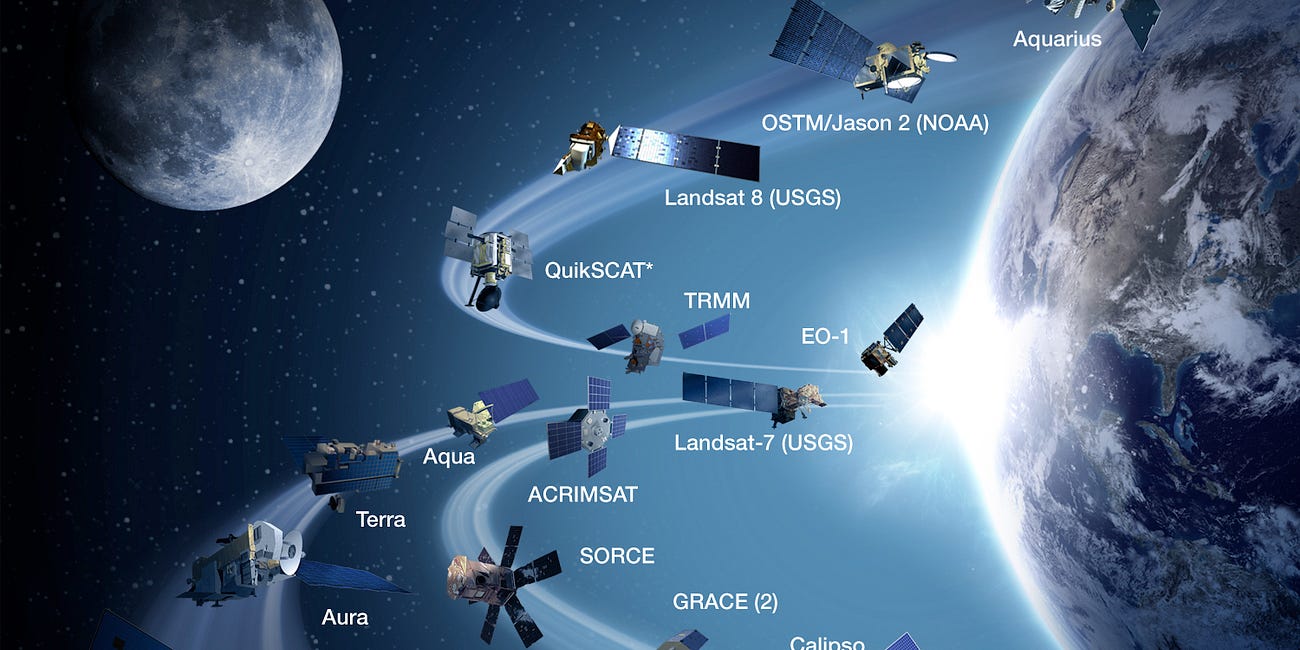

Discussion of the quality of Starlink’s service is less important than the problem it continues to worsen. At the time of Starlink’s rollout, approximately 5,000 satellites orbited Earth. The addition of nearly 12,000 satellites will more than triple the amount of orbital traffic, and Musk wants to send a total nearing 30,000. Starlink satellites have an expected lifespan of five years.

At the end of its lifespan, a non-functional satellite is supposed to de-orbit in a few weeks to a few years based on Earth’s gravity and position. This means that beginning around five years from launch, hundreds of 500+ pound (227+ kg) pieces of space junk will circle Earth at low-orbit until they can manually de-orbit or gravity does the job. Gen2 satellites are even bigger, weighing around 1,750 pounds (800 kg), and the very latest version, the V2s, are expected to reach 4,400 pounds (2,000 kg). These “next gen” satellites have about the same expected lifespan as the earlier ones.

This low-orbit circle of space junk will inhibit optical and radio observations, create a potential debris field for other more important space launches (GPS satellites, manned space missions, etc.), create a regular shower of molten metal into the atmosphere, and possibly inhibit space travel altogether.

Already, one Geostorm resulted in the near simultaneous loss of 40 Starlink satellites. Increasing numbers of objects in orbit around the planet contribute to a phenomenon called the Kessler Syndrome, where a single collision leads to several more, and on and on until everything in orbit is destroyed. Scientists fear it is already beginning.

Diagnosis: Kessler Syndrome

The progress of human utilization of Earth’s orbital space has rapidly accelerated since the first moon landing in 1969. Thousands of satellites have been launched to facilitate the Global Positioning System (GPS), communication, weather observation and modelling,

The National Science Foundation announced an agreement with SpaceX on January 12, 2023 to reduce the visibility of Starlink satellites to mitigate their effect on astronomical observation. Unfortunately, the agreement is only voluntary (meaning SpaceX could simply fail to follow through), but worse, it doesn’t address the real problem of adding loads of debris to low Earth orbit.

Indeed, for the International Dark-Sky Association (IDA), an astronomy organization, the agreement was not enough and therefore it has elected to sue to block Starlink’s future deployment. The organization argued, “it is critical that federal agencies responsible for making decisions on the future of the night sky – an essential element of the human environment – follow existing laws.” Other groups are joining that lawsuit. Note that the suit is in response to the recent approval by the Federal Communication Commission of 7,500 satellites.

It isn’t just interference with astronomical observation at issue, though with the ever-looming threat of asteroid collisions this is a substantial concern. Like all new tech these days it seems, greedy capitalists are more interested in making money from it than considering the negative implications. The International Astronomers Union (IAU) has pointed out that we do not yet know what kind of consequences we might suffer here on Earth by having tens of thousands of units flying—and dying—in low Earth orbit. It adds that “despite notable efforts to avoid interfering with radio astronomy frequencies, aggregate radio signals emitted from the satellite constellations can still threaten astronomical observations at radio wavelengths.”

A program like Starlink wouldn’t be necessary at all if equal amounts of funding were invested in ground-based broadband. Starlink’s launch costs alone will probably reach $600 million just for the initial full constellation (12,000), and will cost approximately $300,000 per replacement satellite thereafter, according to Starlink’s own numbers.

In February 2022, the US Department of Commerce’s National Telecommunications and Information Administration (NTIA) issued grants totaling $277 million to expand broadband to 133,000 unserved households. At that rate of investment-to-consumer, broadband coverage could be expanded to all current Starlink customers for the same cost as launching thousands of short-lived, space-polluting satellites that provide comparatively inferior internet service.

The Biden administration announced just weeks ago an additional $40 billion funding package to extend broadband to 8.5 million more US households. This is projected to create 150,000 jobs and further abrogate the need for satellite internet in the USA. If Starlink loses all or some of its US market, its survivability chances diminish significantly.

The essence of the Starlink program is in Musk’s self-centered desire to propagate his status among some as a visionary. He has repeatedly touted the company as if it offers something new—which, it does… swarms of low earth orbit space junk. New, but not better. Moreover, it ties into his other pie-in-the sky belief that he will somehow lead the charge to colonizing Mars. Starlink’s Terms of Service even include a passage about “services provided on Mars.”

This plan to colonize Mars is nonsensical for a whole bunch of reasons: 1) It requires thousands of rocket launches from Earth, thereby drastically increasing pollution on Earth to benefit the tiny population Musk envisions living on Mars; 2) Musk makes no mention of the potential for cross-contamination (bringing invasive or otherwise harmful items to or from) and appears not to have even considered it; 3) It wastes tons of money for almost no discernable purpose other than to say he did something (yes, perhaps some studies can be done by this ‘colony’ but at a financial, environmental and ethical cost that is nearly inconceivable), 4) And contrary to some supporters’ opinions, colonization of Mars is simply not the same thing as inventing and implementing the telephone or laptop. It is a terrible idea for anyone foolhardy enough to participate.

Musk has been saying since 2011 he would start a colony on Mars within a “decade.” However, as recently as 2022, the plan has been characterized as a “delusion.” On November 25, 2022, Musk claimed on Twitter that “Mars plans are still moving forward.” The internet was not wholly convinced.

Given that the ship Musk envisions to transport people to Mars has not had a single successful flight, delusion seems a suitable way to describe it. Starship’s first orbital test flight ended in an unmitigated disaster in April 2023. That explosion spread dangerous refuse across several miles, leading the FAA to ground the program. Without Starship, many believe Starlink will not be able to expand much further.

The newer satellites Musk wants to launch cannot even be carried by any existing rocket other than Starship. As Starlink’s business model depends upon regularly adding subscribers for its very survival, the failure of Starship will inevitably mean the collapse of Starlink.

Musk’s comments about Starlink resemble his hyperloop statements. He repeatedly makes claims that rarely ever materialize. People invest in it based upon those claims only to pay for inferior products and services in many cases. The business model for the company requires continued investment for its very survival, which hints at the motivation for repeatedly saying it can do things that in reality it cannot. These are the hallmarks of a Ponzi Scheme.

SpaceX

SpaceX is often deemed Musk’s most credible venture because, unlike pretty much all of the others, SpaceX has managed to deliver on some of Musk’s promises even though it doesn’t appear to make Musk any money. Indeed, SpaceX’s current signature vehicle, Starship, has been selected by Nasa to serve as the lander for the manned Artemis missions.

Unfortunately, Starship has only flown 25 miles (40 km) before being blown to pieces by an engine separation failure. As of this writing, the FAA has not cleared SpaceX to conduct another launch. Additionally, SpaceX has not even filed the required paperwork regarding the April incident. This is in contrast to Musk’s statements about 2 months ago that they would re-launch in “6 to 8 weeks.” Without the filing, Starship will remain grounded.

Contrary to Musk’s attestations about saving humanity and sustaining the environment, oft repeated by his fans, SpaceX is actually contributing significantly the other way. There are three areas of pollution to which SpaceX is currently heavily contributing—Earth’s surface, atmosphere, and the space around it. Musk also wishes to use SpaceX to colonize Mars. In addition to the ridiculousness of that idea for the many reasons already articulated, the inevitable result were it to succeed will be polluting yet another area of the universe for no comparably beneficial purpose.

Source: Reuters

In 2017, experts estimated SpaceX CO2 emissions at around 1.3 million pounds, from launches, manufacturing, and other operations. This is equivalent to burning 652,416 pounds of coal. That year, SpaceX launched 18 times, using new and used Falcon 9s for all of them. As indicated in the graph below, there were 31 launches at the high point since, and 13 in 2019 and 2022. Increasing numbers of launches will, of course, raise the emissions number.

Given the turnover required to keep Starlink functional, and based on the schedule of deployments since Starlink’s rollout, SpaceX will need to launch at least 48 times per year just to reach and maintain a 12,000 satellite constellation—and that’s if every satellite in the network survives its full five years. History has shown that the entire constellation will never survive its full lifespan. It also does not take into account up to 20,000 more satellites SpaceX wishes to launch as part of its Gen 2 program.

In 2021, 114 global rocket launches burned about 1% of the fuels used in the global aviation industry, which conducted more than 40.3 million flights. Put another way, 114 rocket launches burned the equivalent fuel of 403,000 commercial flights. SpaceX’s plan for Starlink would comprise nearly 50% more launches by itself.

Source: Statista

Launching a rocket with solid or liquid fuel is harmful to the environment. Solid rocket boosters (SRBs), like the type used to launch NASA space shuttles, burn over 1,000,000 pounds of propellant, comprised of powdered aluminum and ammonium perchlorate. The most dangerous byproduct of the exhaust from these rockets is hydrochloric acid. Dispersal of dangerous chemicals from the exhaust presents a significant environmental problem all along the rocket’s trajectory, as shown in a Canadian defense study of comparably tiny rocket motors using the same type of fuel.

Elsewhere, scientists found holes in the ozone layer along the rockets’ trajectories they studied. The exhaust particles also might reflect sunlight, potentially causing temperature changes in the stratosphere and mesosphere. While these chemicals are used in large rocket boosters for the shuttles and other spacecraft, Falcon 9 uses liquid oxygen and kerosene and Starship will purportedly burn liquid oxygen and methane. Their environmental impact is no better.

The Falcon 9 uses about 440 tons of kerosene for its rockets. Kerosene’s major drawback is black soot and carbon dioxide. Right now, the impact of releasing increasing volumes of these particles in the upper layers of the atmosphere is unknown. A primary concern is that particles distributed into the upper atmosphere tend to stay there for years because of the low atmospheric mixture rate.

Because rocket launches were exceedingly rare in the past, there have been few opportunities to study their effects. With launch numbers increasing by over 5% every year, emissions into the higher layers of the atmosphere will probably create a substantial problem. SpaceX’s Falcon 9 releases the same amount of carbon dioxide as 69 cars do over an entire year—in just the first 165 seconds of its flight. To say again, in less than 3 minutes, a single SpaceX Falcon 9 emits the same amount of CO2 as 69 cars do over an entire year.

As noted above, SpaceX needs to launch 48 times per year just to sustain its smallest proposed constellation of 12,000 satellites. This number will go up significantly with more satellites. If SpaceX cannot ever successfully launch Starship, it will be forced to rely on Falcon 9s.

Starship’s overall environmental footprint is hard to gauge as SpaceX has yet to have a successful flight of the vehicle. In a six-minute test run of Starship’s prototype, the vessel emitted 358 tons of CO2, the equivalent of emissions by 4.6 million people over the same time period. That test did not count the Super Heavy launch vehicle, which employs ten times the number of engines as the prototype.

Mathematically then, Super Heavy probably emits about 2,683 tons of CO2 per launch, plus 1.7 tons of nitrous oxide. Nitrous oxide is 298 times more harmful than CO2, meaning a single Starship launch will emit the equivalent of at least 3,819 tons of CO2. A single launch will emit roughly the equivalent amount of greenhouse gases as emitted by almost 50 million people over the same time period (calculated at 6 minutes), but in reality it will likely be far more.

SpaceX’s pollution problem isn’t limited merely to its various engines’ exhaust. Its central launch facility is riddled with problems. Boca Chica, Texas, contains a launchpad for SpaceX activities called Starbase. SpaceX uses police to cordon off the surrounding area from locals, including the neighboring beach, which is a sacred place to some of the indigenous people in the area.

Starbase sits immediately adjacent to a protected nature preserve, an area which SpaceX activities continue to pollute both with successful and failed rocket launches, according to one lawsuit. That lawsuit was initially dismissed on standing, but is under appeal (for more on how “standing” is often used against environmental concerns, see here).

SpaceX’s latest failure, its explosion of Starship in April 2023, sent a cloud of pulverized concrete raining down over Texas, spewed large chunks of concrete and metal into the wildlife preserve next to the launch site, and ignited a 3.5 acre fire there. SpaceX called that event a “success.” That disaster has led to another lawsuit filed against the company for its environmental damage.

Tangentially related to those lawsuits, the US Federal Aviation Administration (FAA) declined in July 2022 to conduct an in-depth Environmental Impact Statement on SpaceX launch activity at Starbase. This is odd given that the same agency did require SpaceX to “take more than 75 actions to mitigate environmental impacts,” but did not impose any enforcement mechanism.

The FAA’s own directive requires it to consider licensing launch programs “consistent with public health and safety, safety of property, and the national security and foreign policy interests of the United States.” Yet, none of the provisions of the FAA’s report indicate any real response mechanism in the event of SpaceX committing explicit violations once a license is issued. (See the Executive Summary here).

When Starship exploded, several environmental groups sued the FAA to attempt to force it to conduct its own environmental impact statement, instead of allowing SpaceX to do it, noting that “SpaceX has a direct and substantial economic interest in the outcome of this case that the government does not share.” In other words, the FAA should have done the impact study in the first place because SpaceX clearly had and has a conflict of interest.

Bret Johnson, SpaceX’s chief financial officer, submitted a declaration in relation to the lawsuit. In it he does not make any defense of SpaceX’s numerous violations of environmental agreements, rather he emphasizes the fact that SpaceX now has billions of dollars in business that could be damaged or lost if they lose the suit. In a subsequent motion, SpaceX reiterated that its concern is money, not environmental issues, writing that “further licensing of the Starship/Super Heavy Program could be significantly delayed” if the lawsuit proceeds.

On top of the apparent apathy of the FAA, many of the permits that require SpaceX to abide by Clean Water and Coastal Zone Management acts were issued by Texas authorities, who have made no secret of their desire for reaping the benefits of the economic impact of hosting Starbase. So, violations of those particular laws would likely not affect SpaceX’s licensing or permits at the state level. Approvals by other agencies are also expected to be mere rubber stamps.

People living in the area are not happy with these results. SpaceX has a history of failing to meet regulatory or legal requirements, such as here, here, here, here, and possibly here. It also has faced discrimination suits, sexual harassment suits, and was forced to pay out about $4 million for alleged labor violations (though, of course the company claimed no culpability and settled only for “financial reasons”). One can see why locals have little faith in toothless environmental agreements.

Notwithstanding the myriad problems of pollution, and regulatory and labor law violations from SpaceX’s activities, the fact remains that as of this writing roughly 50 percent of all active satellites in orbit belong to just this company. This company is headed by a CEO of tenuous abilities, which begs the question—what happens to all this space junk if SpaceX folds? What happens to the environment if this company succeeds?

Neuralink

Neuralink is a Musk-owned company purportedly working on a wireless implant chip designed to monitor brain function and improve certain bodily functioning for brain-damaged individuals. Among his motivations for starting Neuralink, Musk stated it was to “avoid AI becoming other.” This was in response to the question of whether Neuralink was a “counter for skynet,” a fictional AI program in the Terminator movies.

Musk also said of Neuralink’s objectives, ““If I were to communicate a concept to you, you would essentially engage in consensual telepathy. You wouldn’t need to verbalize unless you want to add a little flair to the conversation or something … But the conversation would be conceptual interaction on a level that’s difficult to conceive of right now.” Experts remain highly skeptical, at least of the timeline Musk proposes. As Antonio Regalado of the MIT Technology review noted, this kind of technology might someday be possible, but “that future is not as close at hand as Musk would have you believe.”

To further the technology its developing, Neuralink tests on animals, the welfare of which has led to an investigation by the US Department of Agriculture’s Inspector General. Purportedly, the USDA is investigating violations of the Animal Welfare Act. Musk’s company has killed about 1,500 animals since 2018, many of them reportedly unnecessarily as a result of poorly prepared and repeated experiments.

The Physicians Committee for Responsible Medicine collected Neuralink’s own documents which reveal the alleged abuses and turned them over to the government accompanied by a 700-page letter. Complaints about Musk’s company’s abuse of animals long preceded the start of the investigation. The USDA has cited Neuralink for ineffective efforts at ensuring animal welfare at least three times since 2014.

Questions have been raised more recently about the membership of the board overseeing the company’s animal research, a board required by federal law. Reuters reported that nineteen of the board’s twenty-two members were Neuralink employees, several of whom stand to gain financially (in the millions of dollars) if the company succeeds.

The US Food and Drug Administration has already denied Neuralink’s bid to conduct human experiments once, in part because it could not validate its product’s safety in its animal testing. It is considered a conflict of interest for panel members to have a financial stake in the product whose procedures they are overseeing.

The US National Institutes of Health, for example, which is the world’s largest public funder of biomedical research, prohibits any person who stands to profit financially from overseeing any aspect of animal research on the project. Furthermore, the US Department of Agriculture (USDA) also forbids “review or approval of an activity in which that member has a conflicting interest.”

So far, the USDA has not filed a formal citation related to this apparent conflict at Neuralink. One federal official told the Financial Post that “Inspectors likely would have examined the potential conflicts more closely if those connections were disclosed,” but Neuralink never did disclose them. This is yet another apparent dereliction of duty of governing authorities, and a legally questionable pattern of conduct by a Musk-owned company.

In 2019, Musk announced that Neuralink was preparing to move toward human testing in 2020, though at the time of that announcement it was not publicly known that any testing had even been done on animals, other than rats and mice. The US Department of Transportation is now investigating whether Neuralink complied with federal guidelines regarding the transport of dangerous pathogens, such as antibiotic-resistant staphylococcus and herpes B virus related to testing.

The allegation states that Neuralink carried the pathogens on removed implants from monkeys after improper sanitization and packaging. Public records collected by the Physicians Committee for Responsible Medicine contain an email from a UC Davis employee who purportedly wrote, “This is an exposure to anyone coming in contact with the contaminated explanted hardware and we are making a big deal about this because we are concerned for human safety.” According to Reuters, employees said Musk’s “pressure on Neuralink’s staff to make progress contributed to mistakes plaguing some experiments.” This was another reason Neuralink’s previous requests to begin human experiments had been denied.

In May 2023, unfathomably, the FDA finally did grant approval to Neuralink to begin human testing, though the company stated it does not have a timetable to do so. Curiously, that approval came days after Swiss researchers announced that their neural implant enabled a paralyzed man to walk for the first time since his injury.

Another company, Precision, that was started by a former founder of Neuralink, has also successfully conducted human clinical trials. Five of Neuralink’s original founders quietly departed from the company to do other things within its first few years. Well one, Tim Hanson, did not go quite so quietly. Perhaps in response to Musk’s relentless pressure on and poor treatment of employees, Hanson had told MIT Technology Review that Neuralink was not ready to move toward human testing. Musk retorted to the story on Twitter that Hanson was a “short term employee who didn’t work out.” Hanson replied that Musk was a fake engineer and fake founder of Tesla.

Like he does with all his companies, Musk promised that Neuralink would be ready to conduct human experiments in the “next year” numerous times, over numerous years. Scientists experienced in the field were skeptical of most of Musk’s claims about what Neuralink would eventually be able to do right from his unveiling of the company.

At that event, Musk said that the product would: 1) be implanted in a one-hour, same-day visit without anesthesia, 2) cure blindness, 3) add superhuman vision like UV, Radar or X-ray, 4) cure hearing loss, 5) cure extreme pain, anxiety or addiction, and 6) enable telepathic communication. Probably the most ridiculous claim is what Musk called implementing “AI symbiosis,” or providing an implanted person with capabilities similar to fictionalized artificial intelligence.

Jerome Pesenti, VP of AI at Facebook, stated that Musk “has no idea what he is talking about when he talks about AI.” Musk childishly snapped back “Facebook sucks.” Neuroscientist Miguel Angelo Nicolelis, Distinguished Professor of Neuroscience at Duke University, and a world-leading researcher in brain implants, said of Musk’s Neuralink claims that he seems to have only a “faint idea” of where the brain is located or how it works.

In 2020, four years after Neuralink’s founding and the first of Musk’s grandiose claims about the company, Antonio Regalado wrote in the MIT Technology review that Neuralink is “neuroscience theater.” After a presentation of Neuralink’s capability in the summer of 2020, Andrew Jackson, professor of neural interfaces at Newcastle University, observed, “I don't think there was anything revolutionary in the presentation.”

Rory Cellan-Jones later tweeted this statement and added, “this is solid engineering but mediocre neuroscience.” Neuroscientist Randy Bruno expressed doubt that many of Musk’s claims were possible, though he stated his belief that Neuralink might be helpful in some specific areas of brain research.

The only claim Musk has made that comports with what Neuralink seems to really be working on is correcting some issues related to paralysis. In two hours of discussion with Joe Rogan in 2020, Musk discussed this aspect of the project for about one minute and a half, and restated the claim that they would be implanting a human in “less than a year” (a mantra he repeated over and again in that interview despite it always being false).

He also reiterated false claims such as that Neuralink would cure eyesight or “pretty much anything… that is wrong with the brain.” In addition, he continuously stated that people would gain something akin to super capabilities, such as instant language learning and other features that virtually no expert believes possible anytime soon, if at all (though Musk, like usual, says this will all happen in 5 to 10 years).

Similarly to some of his other companies, Neuralink has seen infusions of funding that correlate with the timing of Musk’s audacious claims. As a startup, the company raised $51 million. Not long after Musk began loudly proclaiming Neuralink’s eventual capacity to endow people with superhuman abilities, the company received investments from 12 entities, bringing the company’s total to $363 million.

One claim Musk made was, “With a direct neural interface, we can improve the bandwidth between your cortex and your digital tertiary layer by many orders of magnitude. I’d say probably at least 1,000, or maybe 10,000, or more.” No evidence—or logic—support this claim. The 12 investors who contributed money following that statement included Sam Altman (OpenAI) and Google Ventures.

Regarding these claims, Dr. Karola Kreitmair, assistant professor of medical history and bioethics at the University of Wisconsin, stated “I worry that there's this uncomfortable marriage between a company that is for-profit” and the ethical application of its technologies. Dr. Laura Cabrera, a neuroethics researcher at Penn State, said “With these companies and owners of companies, they’re kind of showmen. They’ll make these hyperbolic claims, and I think that's dangerous, because I think people sometimes believe it blindly.” She added, “I'm always cautious about what [Elon Musk] says.”

Cognitive psychologist Susan Schneider stated, "While I’m excited about the therapeutic applications of brain chips for those with movement and memory problems, I worry about the widespread use of brain chips in the future.” She added, “Without proper regulations, your innermost thoughts and biometric data could be sold to the highest bidder.” In the USA, at least, proper regulation seems little more than a pipe dream. [see the article below]

Weaponizing Xenophobia

Montana became the first US state to ban downloads of the TikTok app and in-state operation of the company on May 17 of this year (effective January 1, 2024). Republican governor Greg Gianforte applauded his signing of the law stating in a press release, “The Chinese Communist Party using TikTok to spy on Americans, violate their privacy, and collect th…

In sum, Musk has made numerous claims that experts largely consider to be false or misleading, and his company has seen contemporaneous infusions of investments as a result. This evidences his habit of raising capital based on making knowingly false statements, conduct which has been criminally prosecuted in many other cases.

Twitter (X)

Twitter exemplifies the conclusion that Musk is a CEO of “tenuous abilities.” Musk’s antics involving the platform provide an abundance of evidence that despite his attestations, his motivation is never driven by beneficent goals. Musk has been quoted (via tweet, of course) as having bought Twitter because, “it is important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner without resorting to violence.” He tweeted this to his advertisers (who, by the way, are virtually the sole source of income for Twitter):

He made numerous other statements on his alleged belief in free speech on Twitter. “I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.” And “Free speech is essential to a functioning democracy.”

Not long after assuming control of Twitter, he banned several accounts that made fun of him personally. Yet, he tweeted, “My commitment to free speech extends even to not banning the account following my plane, even though that is a direct personal safety risk.”

A few weeks later, he banned the account “following his plane” despite the fact that the information tweeted by that account is readily available public information, and the account posted no different content than the information tweeted at the time of Musk’s statement about not banning it. He tweeted in April 2022, “By 'free speech,' I simply mean that which matches the law. I am against censorship that goes far beyond the law."

In January 2023, he removed a BBC documentary from Twitter in India that was critical of PM Narendra Modi, even though posting the video was not illegal there, while government-enforced banning may be. Notably, Musk’s attempts to enter Tesla into the Indian market had to that point, been without success.

Months later, Musk met with Modi and then stated that Tesla is looking to invest in India “as soon as humanly possible,” and that Modi “really cares about India because he’s pushing us to make significant investments in India, which is something we intend to do. We are just trying to figure out the right timing.” Since Musk took control of the company, Twitter has acquiesced to 83% of governments’ requests to censor content, in many cases that directly influenced elections. Before Musk, Twitter conceded to such requests 50% of the time.

In October 2022, he tweeted “A beautiful thing about Twitter is how it empowers citizen journalism – people are able to disseminate news without an establishment bias.” Two months later he suspended numerous journalists covering stories about Twitter. He then posted a poll on Twitter asking whether he should reinstate the accounts. When the majority chose the option to reinstate “now,” Musk replied “sorry, too many options. Will redo poll.”

Musk also directly ordered the banning of Chad Loder, who was known for using Twitter to identify January 6 participants. January 6 is the moniker for what now can only be characterized as a half-witted coup attempt in the United States, a bumbling effort that has led to the imprisonment of hundreds of people, and the indictment of thousands.

Loder’s ban, among others engaged in similar activism, seems to have partially been the result of the efforts of a group called Zanting, which published detailed instructions on Substack on how to get these types of accounts banned (I will not link to Zanting’s page directly here). Twitter execs knew of the campaign and planned to stop it as it violated Twitter’s terms of service, but Musk fired them before they could.

Then, of course, there is a long history of tweets by Musk both before and after his acquisition of the company that are provably false, and that have landed him in legal trouble with the SEC, investors, and more (see below).

Enter the so-called Twitter Files. Musk and certain people he had picked to promote them have proclaimed that the files “prove” that Twitter was censoring Republican politicians in America and so-called right-leaning content. Twitter algorithms, however, have been found to boost right-leaning content more than others, both before Musk’s purchase and especially after. But, the tendency to share false or otherwise harmful messaging is much higher among self-identifying Republicans or so-called right-wingers and thus they are more frequently subject to bans.

Moreover, a review of the Twitter Files themselves (at least the seemingly cherry-picked ones provided to the public) reveals a lot about what Musk’s hand-picked promoters barely mention: members from both political parties were engaged in the same practice of making requests about removing specific content. Twitter staff seemed to respond to them in largely the same manner—typically uncertain about what to do—though their resultant action varied depending upon the nature of the content (and little of it in total was suppressed).

Matt Taibbi, one of the journalists selected by Musk who sacrificed his career and integrity to promote Musk’s clown show, himself reluctantly admitted that his initial accusations that the FBI tried to block stories about the Hunter Biden laptop, an example of a major controversy in American politics, were simply lacking any evidence.

Taibbi scuttled away from the Twitter Files debacle after Musk entered a war with Substack—this online publication forum—where Taibbi makes most of his income. Musk then accused Taibbi of lying about the feud with Substack and suggested Taibbi had a financial interest in doing so. Since then, the Twitter Files have all but left the American political lexicon. The whole affair seemed more of an attempt to garner attention (and revenue) to a platform that under Musk’s control has lost approximately two-thirds of its value, and has suffered one technical embarrassment after another.

Musk’s handling of Twitter, especially juxtaposed with his other business ventures discussed so far, reveals the complete lack of credibility in what he says. The nefarious aspect of Twitter is in how Musk has used it to perpetuate his crimes. The cases outlined above may arguably comprise incompetent business practices coupled with P.T. Barnum-styled promotion, but what follows clearly demands criminal investigation. The businesses discussed above provide contextual evidence of Musk’s state of mind and help substantiate a pattern of criminal fraud. Not to mention, their inability to earn Musk money offers him a motive to commit fraud in his other ventures.

Note: I didn’t even bother to discuss the latest Twitter failure, its rebranding as X. Keeping up with the controversial or illegal things Musk does is rather difficult.

SolarCity

SolarCity was founded by Musk’s cousins, Peter and Lyndon Rive, in 2006, becoming the leading residential solar installer in the USA by 2013. In 2014, it announced a public offering, but by 2015 the company already faced major financial problems. On the heels of SolarCity’s economic decline, SpaceX bought $90 million in SolarCity stock in 2016 (Musk himself already owned a financial stake).

Later that year, Tesla acquired SolarCity for $2.6 billion, a transaction which led to an investor lawsuit accusing Musk of “bailing out” a company in which he owned $533 million in stock. Among his defenses, Musk claimed he didn’t think the company was “financially troubled.” Musk prevailed in that lawsuit primarily because shareholders could not prove a loss to Tesla as a result. Among the accusations in the suit, however, was that Musk “unveiled a product that didn’t yet function.” That accusation only represents a part of the scam, but is a key factor in the series of frauds that follow.

In the fall of 2014, New York State awarded SolarCity the free use of its “Riverbend” factory at a cost to the state of $750 million for refurbishing and equipping the plant. In return, SolarCity agreed to employ 1,500 “high-tech” workers there and 4,900 across New York State in total. SolarCity never met those numbers despite receiving the full end of New York State’s commitment.

Like the way Musk has falsely promoted other ventures, at the time of the negotiation Musk announced SolarCity was “about two years” away from reaching a 1 GW manufacturing capacity—what would be a significant achievement. But it never came close. Instead, SolarCity and Dr. Alain E. Kaloyeros, the person charged with the “supervision, management and operation of the Program,” continuously amended the agreement between the company and the State allowing delay after delay of this and other milestones. By mid-2018, the factory employed just 800 workers, about half of its original agreement. And most of those were paid entry-level wages, which also violated the agreement.

The approaching collapse of SolarCity to that point included more than missing agreed-upon milestones. The company seems to have been in big financial trouble prior to sealing the deal, relying on a business model that eerily resembled a pyramid scheme. SolarCity fronted the costs of residential solar installations allowing homeowners to pay back over time, either through a lease of the equipment or through payments for the electricity the panels captured. This meant that for SolarCity to make enough money to remain stable and continue with new installations, it needed frequent investments where the dividend would be paid by customer payments.

As a service, SolarCity received very low grades, and was even sued by Walmart for defective panels that caused a damaging fire. Walmart accused SolarCity of conducting “an ill-considered business model that required it to install solar panel systems haphazardly and as quickly as possible in order to turn a profit.” That case eventually settled. Nevertheless, Musk was repeatedly telling investors that the company was nearing “a breakthrough” that would somehow make it viable. This “breakthrough” was eventually exhibited at a presentation where Musk personally heralded solar panels that looked like roof shingles.

New York State Governor Andrew Cuomo, who has since resigned in disgrace amidst accusations of sexual improprieties, seemed wowed by the idea of bringing industrial life to Buffalo’s Riverbend area via SolarCity. Cuomo either didn’t do his homework, or had other motivations for going through with the deal. After all, Musk’s own cousins were selling their stock, key executives were leaving in droves, and Goldman Sachs called the company the “worst positioned” for future growth.

Musk, meanwhile, quietly started borrowing against Tesla and SpaceX to buy bonds to float the company, and when that had limited effect he very publicly bought an additional $10 million worth of SolarCity shares to artificially jostle the market. That led to a temporary 25% increase in the stock. Finally, in a last-ditch effort, Musk had Tesla acquire SolarCity in a deal that eventually came before a court, brought there by Tesla investors who felt defrauded.

The Delaware Court of Chancery judge wrote, “[Musk] was more involved in the process than a conflicted fiduciary should be. And conflicts among other Tesla Board members were not completely neutralized.” Still, Musk avoided liability while several other board members settled the case for their roles in the deal. It is widely believed (at 3:50) that without Tesla absorbing SolarCity, Musk’s bond debts to SpaceX might have caused that company to go bankrupt as well.

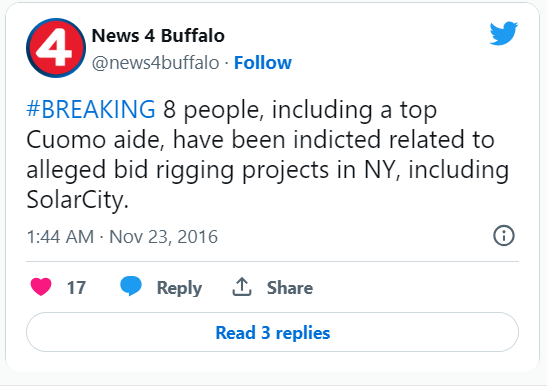

The whole deal with New York State appeared to be a giant bid-rigging and bribery scheme that provided Tesla a 1.2 million square foot plant, effectively for free. Indeed, several people were criminally charged and convicted for related offenses.

Kaloyeros was ultimately convicted along with Steven Aiello, Joseph Gerardi, and Louis Ciminelli for wire fraud and conspiracy related to the deal. New York Governor Andrew Cuomo’s closest aide, Joseph Percoco, was convicted of bribery and bid-rigging. Another top Cuomo aide, Todd Howe, pleaded guilty to eight corruption charges. Percoco and Ciminelli later won on appeal, but not for a lack of proof of their conduct, rather as the result of a twisted interpretation US courts continue to use to release public figures from criminal liability for acts of bribery.

Despite these convictions, and the obviously criminal deal, Tesla still ended up with the subsidized factory, even though less than one-quarter of the work force does any solar-related manufacturing. Instead, they are simply doing work related to producing Tesla cars. None of the original requirements appear to have been met. This is primarily because Musk never had a “revolutionary” product to produce. In 2016, on the set of the show “Desperate Housewives,” Musk introduced solar roof tiles with which SolarCity was set to “revolutionize” the market. These were alleged to be solar panels that looked like standard roof tiles.

Source: the Guardian

There was one problem. The tiles were fake. Musk literally stood up on TV and hawked an almost entirely fictional product (there were 12 roofs across the entire USA that received some prototype version of these tiles). Nevertheless, Tesla continued taking deposits for them.

Like his other products that have never reached manufacturing capability, Musk continued telling shareholders that the breakthrough to mass-produce the tiles was “coming.” The fraud was perpetuated by Empire State Development spokeswoman Pam Lent who encouraged Tesla officials in 2019 to proclaim that the plant was still “in r and d mode” to explain its lack of production, despite Musk’s claims nearly three years prior that the product already existed as advertised. One of Tesla’s own senior employees described solar production at the plant as “a bad design all around… a poor product design, and then the manufacturing design was not sufficient to bring it to scale.”

In 2020, Tesla and Panasonic (who provided manufacturing for some component parts) ended their relationship because Tesla had begun importing solar cells from China over the previous year. In December 2021, Tesla stopped solar panel production altogether because the federal government banned many solar components produced in China “amid concerns they were produced with the help of slave labor.”

In 2022, the company resumed solar panel production, but nowhere near any of the standards set by the original agreements. One Silicon Valley figure, Allen Greenspan, noted that he was surprised Musk and Tesla were able to “get away with outright lying” to New York State. An investor analyst who studies Tesla said “Buffalo definitely got sold a bill of goods.”

SolarCity Crimes

There is a strong case here for a variety of fraud and conspiracy charges to levy upon Musk. United States Code Title 18, § 1343 makes it a crime to “devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, transmits or causes to be transmitted by means of wire, radio, or television communication.” To convict someone of wire fraud (as 18 USC § 1343 is called), prosecutors must prove each of the following elements:

1) the defendant voluntarily and intentionally devised or participated in a scheme to defraud another out of money;

2) the defendant did so with the intent to defraud;

3) it was reasonably foreseeable that interstate wire communications would be used; and

4) that interstate wire communications were in fact used.

Musk knew SolarCity was failing, but he had a large amount of money invested in it, so he devised a complex scheme to “bail” it out, just as the investor suit claimed. That he borrowed against SpaceX, thereby threatening the viability of that company, Musk had an extremely strong motive to ensure SolarCity’s survival.

On one side, he managed to convince New York State to effectively give him three quarters of a billion dollars in a deal that landed numerous people in jail. While little evidence has surfaced indicating whether Musk knew of the scheming happening among Percoco and other defendants, he almost certainly did know about the ‘advice’ from Empire State Development spokeswoman Pam Lent, who encouraged Tesla officials in 2019 to proclaim that the plant was still “in r and d mode” to explain SolarCity’s lack of production.

Before, at the time of, and after that email Musk kept making statements that the development of SolarCity’s ‘revolutionary’ tiles was '“almost there” and the company continued to take deposits. He had to do so because of its Ponzi-like business model, one in which Musk and his engineers knew full well they were nowhere near being able to produce what they touted. Toward that end, Musk went on TV to present his ‘revolutionary’ tiles that were fake.

In simple terms, the SolarCity scheme clearly indicates a fraud against both the taxpayers of New York State as well as the customers who made deposits predicated on Musk’s misrepresentations—and cover up—of the product’s availability.

Cryptocurrency

In February of 2021, Tesla announced that it had purchased $1.5 billion in Bitcoin and shortly thereafter that it would accept Bitcoin as payment. New York University Economist Nouriel Roubini claimed that Musk’s tweets about it amounted to an effort to pump up the price of the cryptocurrency. Indeed, Musk had stated, “Tesla will not be selling any Bitcoin,” meaning it would keep its current share, thereby helping stabilize its value.

Bitcoin’s valuation hit an all-time high shortly after the announcement. Tesla’s share of Bitcoin increased by more than $1 billion by April that year based on the cryptocurrency’s sudden, record-setting jump following Musk’s tweets. A month later, Musk suddenly announced that Tesla would not accept Bitcoin as payment any longer, just two months after the company began the program. Tesla then sold most of its share of Bitcoin, realizing a $106 million profit. The whole thing sounds like the very definition of a pump-and-dump scheme. While Musk (somehow) escaped accountability for the Bitcoin debacle, he is so far having less luck with another cryptocurrency, Dogecoin.

Dogecoin is a cryptocurrency created in 2013, named after a Shiba Inu dog. Largely considered an unstable cryptocurrency because of a lack of caps on the number that can be produced, its highest valuation was 50 cents until Musk got involved. Keith Johnson, a Dogecoin investor, filed a class-action suit last month against Musk, Tesla, and SpaceX. He alleges that the defendants “are engaged in a crypto pyramid scheme (aka Ponzi scheme) by way of dogecoin cryptocurrency.” The lawsuit further states, “Defendants falsely and deceptively claim that dogecoin is a legitimate investment when it has no value at all.” [What follows is primarily sourced from the class-action complaint, except where noted].

The day before the above tweet, Geometric Energy Corporation released a media statement saying that the “first-ever commercial lunar payload in history paid entirely with DOGE—will launch aboard a SpaceX Falcon 9 rocket.” In the following days, Dogecoin’s price went up.

Further tweets by Musk drove the price up even further. For example, on May 13, he tweeted a picture of the interior of a Tesla car and wrote, “DON’T PANIC” followed by a post that read, “Working with Doge devs to improve transaction efficiency, potentially promising.” The price of Dogecoin rose 50% over the next day. On May 20, 2021, he tweeted “Yeah, I haven’t & won’t sell Doge,” a very similar statement to that which he made about Tesla and Bitcoin.

In another tweet about two months later he wrote, “What are you trying to tell me, that I can make a lot of money with Dogecoin?” He replied to his own tweet with, “No Neo. I’m trying to tell you that Dogecoin is money.” Again, the price spiked by 20% in the next 24 hours. This occurred repeatedly over about two years.

Over those two years, the cryptocurrency’s market cap rose by more than 36,000%. Musk then changed the Twitter logo to a Shiba Inu dog in April, which led to another 30% increase in the cryptocurrency’s price. Shortly thereafter, Musk apparently sold $124 million worth of Dogecoin, which led to a precipitous crash in the value of the currency.

At the time of the filing of the lawsuit, the price of Dogecoin was just 7 cents. Musk claims, however, that he did not own any Dogecoin and never sold any. This is in direct conflict with his tweet on May 20, 2021, in which he wrote “Yeah, I haven’t & won’t sell Doge.” Regardless, Tesla began accepting Dogecoin for payment for some things in May 2022—a year before the lawsuit—and Musk announced on Twitter that SpaceX might also begin accepting it “one day.” It is unclear if either still accepts the currency now. The lawsuit remains in-process.

Crypto Crimes

A pump-and-dump scheme involves making false representations to boost the price of a stock or other security with the intent to sell it off at a high point before it ultimately crashes. This kind of fraud is becoming especially popular with cryptocurrencies.

Typically, a group will hatch a plan to promote a currency and will solicit non-group members to invest along with them. The group will wait until the price reaches a sufficient (but soon-to-be-untenable amount), then sell off all at once in coordination with each other. This usually cripples the cryptocurrency, leaving the remaining investors with a shortfall (or nothing) while the scammers rake in profit.

For someone like Musk, with a public following numbering in the hundreds of millions, there was no need for a conspiratorial group as it is clear from the timeline of his tweets juxtaposed with the currency valuation that he could affect the price all by himself. This theory is further supported by his same actions with Tesla stock. There, he repeatedly hyped the company only to make huge divestments shortly thereafter. Musk has stated “I might pump, but I don’t dump,” yet the evidence indicates exactly the opposite.

Pursuing defendants involved in pump-and-dump schemes related to cryptocurrencies is in its infancy. At least one US federal court has found that cryptocurrency can be the basis of an ‘investment contract’ if it satisfies the three prongs of the Howey test.

The first requires an investment of money. No issue there. The second prong demands that investors relied on a ‘common enterprise.’ Specifically, the “test requires the movant to ‘show that the investors are dependent upon the expertise or efforts of the investment promoter for their returns’.” Musk’s strongest defense on this element would require him to deny his own expertise or efforts. Both of those would probably be very difficult for him.

His tweets strongly suggest that he made many efforts to promote the currency, and the results seemingly confirm it. While his expertise might be debatable, the prosecution could easily line up dozens of witnesses who held a reasonable belief in his expertise.

The final prong also creates some question, though the facts in the Dogecoin case would probably be sufficient to satisfy it. It reads: “investors expect their profits to come solely from the efforts of others.” In the case SEC v. Arbitrade, the court noted that this prong is defined rather broadly. The efforts of others, the court stated, “embodies a flexible rather than a static principle, one that is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits,” (quoting SEC v. W.J. Howey Co).

Of note, the above paragraph’s discussion of cryptocurrency as the basis for a pump-and-dump scheme emerged from a civil case. US criminal courts do sometimes rely on civil cases for definitions or other guidance, particularly in actions that come before them on novel issues of fact or law. Many people have been convicted for pump-and-dump schemes related to penny stocks and other investment instruments. Those cases would also be instructive in a criminal case related to Dogecoin.

Jeffrey Martin, for example, was charged with conspiracy and multiple counts of securities and wire fraud related to his role in such a scheme. The court wrote, “Martin allegedly sought to artificially inflate the share price of certain penny stocks and sell his shares at a substantial profit, to the detriment of the investing public.” He did this by “securing effective control of the companies and their stock, creating and releasing false and misleading company information to the public and engaging in manipulative trading of the shares.”

In an appeal related to a civil tax finding, the Court of Appeals discussed several criminal cases involving pump-and-dump schemes. Among those examples, the court described the crime as follows:

[The Defendant] would arrange to purchase large blocks of stock in various companies and then encourage its clients to purchase those stocks. This sudden rush to buy a significant number of stocks would inflate the price of that stock. [The Defendant] would subsequently sell the stock that it owned at this inflated price, resulting in gains for the company. But when the stock price would eventually decline back to a normal level, the company's customers would inevitably incur a loss because they had purchased those stocks at the inflated price. [Citations omitted]

In Ohio in 2021, a court found that Paul Spivak “obtained and concealed beneficial ownership in free trading shares in US Lighting Group stock and then conspired to promote the stock by coordinating press releases with planned promotional programs aimed at raising the share price and trading volume so he and his alleged co-conspirators could then sell the stock at an artificially high price.” He and these other defendants were charged under 15 U.S.C. §§ 78j et. seq. (among other crimes). The pertinent part of that statute reads:

It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange

(b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered, or any securities-based swap agreement any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. [Emphasis mine]

This law seems to directly proscribe Musk’s conduct in the Dogecoin case. Of course, the first indicia of guilt will require proving that Musk did in fact own, sell, and profit from the sale of Dogecoin, a claim he has denied. If that fact is confirmed, however, a successful prosecution would also need to prove Musk’s efforts did in fact cause the price to artificially rise and that he engaged in some sort of deception in order to profit from it.

Musk’s tweets constantly suggesting Tesla’s and SpaceX’s use or planned use of Dogecoin seems to be strong evidence indicating efforts to raise the price of the cryptocurrency. He even proclaimed that Dogecoin “is money.” What might be more challenging to prove is Musk’s intended deception that defrauded investors. Stating he would not sell any Dogecoin and then later turning around and doing the opposite is evidence of an attempt to defraud, but by itself does not seem sufficient to prove it. Such intent can be provable through circumstantial evidence, so investigators would look for it in the form of witness statements, emails, text messages or other conveyances.

Tesla

In 2015, Musk said of Tesla self-driving cars: “we’ll be there in a few years.” Later that year, he claimed that Tesla would have autonomous driving on highways and some roads in about “a month.” In 2016, he stated that his self-driving Teslas would be ready to travel from New York to Los Angeles by sometime in 2017, “without the need for a single touch” from a human driver.

In June of 2018, he tweeted that “full self-driving features” would be rolling out that August. In February 2019, he said Teslas will be able to operate without drivers at the end of that year. Fast forward to July 1, 2023—8 years later. Tesla states on its website that its Autopilot can “assist” with driving under “your active supervision.” In other words, still not “self-driving.”

The National Highway Traffic Safety Administration is investigating Tesla’s Autopilot and “self-driving” features based on numerous fatalities and traffic accidents involving these systems. The SEC has begun investigating Musk’s statements about the Autopilot features, presumably predicated on the idea that he fraudulently misled investors.

Part of that may involve a 2016 video, the creation of which Musk apparently micromanaged, that shows self-driving capabilities that simply did not exist in any manufacturable format. Though the claim was made that the video was showing what future Teslas could do, the version released for public viewing strongly suggests that it was referring to present capability. And Musk had this to say about it:

As of this writing, Musk is facing a class action lawsuit by shareholders over his alleged misrepresentation of the safety of Tesla’s autopilot features. Tesla vehicle owners also filed a separate class action suit in 2022 accusing the company of lying to customers about the capabilities of the autopilot system. Among other things, the suit claims Tesla, and Musk individually, “broke several warranty, false advertising, negligence, fraud and deceit laws.”

The majority of Musk’s wealth is directly dependent upon Tesla’s success. The US Securities Exchange Act, Rule 14a-9, makes it illegal to make “any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact.”